By Savannah Prager

December 1, 2022

On her way to class in Greenwich Village, NYU journalism student Elle Liu used to stop in a coffee shop for her daily $8 Matcha latte. Now, on a semester abroad in Prague, she has a daily hyper-fixation: espresso tonics, at half the cost of her lattes. Yet, her wallet is more drained than ever. Self-proclaimed caffeine addict Liu drops into Osada, her favorite café, to order her drink three to four times per day. “Proportionately, it doesn’t make sense to me that I’m spending this much on coffee, but I think it’s a habit thing,” she said. “When I see the number in Czech Crowns, I automatically think it’s cheaper. It makes me want to buy more.”

Other study-abroad students share her experience of spending more because prices are lower. Arriving in a country where a chai latte with oat milk is CZK 80, (USD $3.19), compared to New York’s $5.50, American students’ wallets have flown open. After overspending the first few weeks due to the illusion of conversion rates, students find they need to budget better to afford all the perks of a semester abroad.

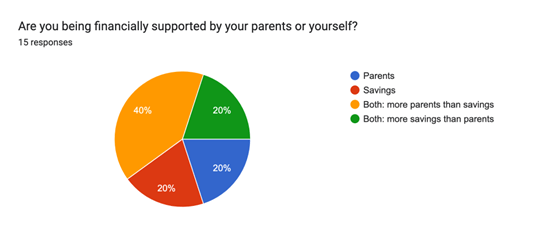

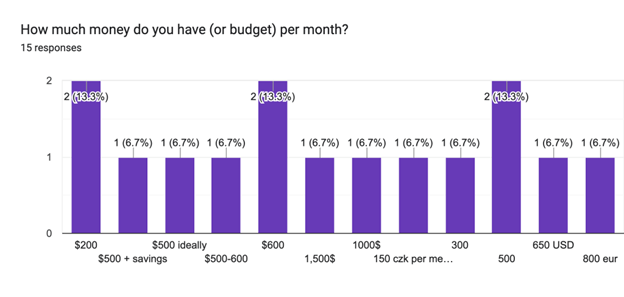

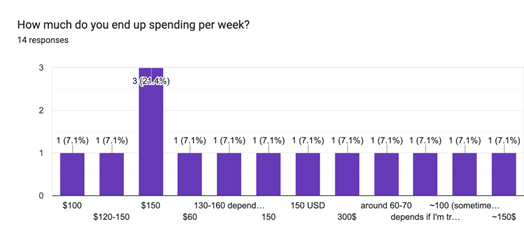

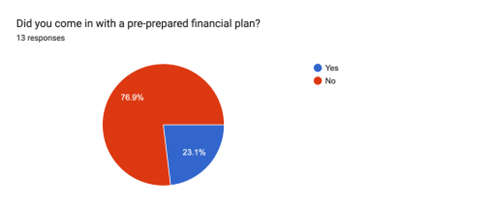

To find out how students spend their money in a country where everything seems a budget buy, we conducted a decidedly unscientific survey in late October. About 15 NYU students listed their monthly budgets, how they were financially supported, and their weekly spending habits. While answers varied widely, the average spending was around $600. Compared to their New York budgets, some students spent the same amount while, confusingly enough, others have ended up spending double in Prague.

The exchange rate is the primary culprit that compels Liu and other students to overspend, researchers have found. Mental math on the fly is not a strong point for many. In Prague, for example, to figure its conversion to U.S. dollars students roughly divide the price in crowns by 25. Quick mental math leaves students stumped, trying to translate prices into dollars. Currency differences can trick the brain. Studies have found that travelers tend to round up a rate where the currency is a fraction of their home currency, leading to misperceived lower prices and greater spending.

Another problem is that “foreign currency tends to look like monopoly money,” University of Virginia Professor of commerce James E. Burroughs commented to StateFarm. And that coupled with perceived lower pricing, causes some students to overspend. While a CZK 80 coffee is a great deal, students forget that having one every day maybe deplete this budget. Gallatin student Maya Masa’deh has also fallen prey to this phenomenon. “In New York, I’d get a coffee maybe twice a week. Here? Everyday.”

To deal with their spending like it’s Monopoly money, students reason they can always get a job back home. Afterall, they’ll never be 20 in Prague again. After spending the summer working at a butcher shop, Gordon chose to put his savings towards experiencing new countries and cultures. “I think traveling here has been a large expense that I normally wouldn’t have, that I’ve decided is worth it,” For him and others, the experiences have been priceless; they’ll deal the empty wallets at the end of the semester.